Fundamental Accounting Framework in Dynamics AX: Financial Transaction Posting

- Nov 25, 2017

- 4 min read

Architecture and Challenges of AX Financial Posting

Dynamics AX as an ERP system has a standard 3-tier architecture: Front End, Middle Tier and Back End.

AX Front End User Interface (UI) was originally based on then popular programming paradigm of OO (Object Oriented Programming). This programming paradigm is more appropriate for individual applications than for enterprise business applications from the data perspective. OO allows for property and method overriding which would result in loss of data integrity. Traditionally, enterprise business applications are built on top of relational data base, which guarantees ACID (Atomicity, Consistency, Isolation, Durability). AX Back End is relational with its data stored in SQL Server. The relational model is built more retrospectively on top of the OO model than a relational DB based enterprise system.

OO model, however, allows more flexibility in programming and visualizing the data. The layer model is an example of these.

The flexibility contributes to the complexity of defining the posting profiles and how the posting profiles are used in transactions.

It’s always helpful to remember that OO model plays a critical role in AX architecture and the financial posting. For example, the same parameter could be defined at the module level (Company level), business relation level (Customer or Vendor), line transaction level (Item level).

Major Scenarios in an ERP System

We will use the Dynamics AX 2012 R3 to illustrate the financial posting processes in AX. Some standard business scenarios are covered here to include buying goods from suppliers, selling them to customers and eventually performing business accounting. The following processes will be covered.

Procure to Pay

Purchase Order Creation and Confirmation

Receiving of Confirmed Purchase Orders

Vendor Invoicing

Vendor Payment

Order to Cash

Sales Order Creation and Confirmation

Picking, Packing and Shipping for Confirmed Sales Orders

Customer Invoicing

Customer Payment

Record to Report

Trial Balance Report Before

Perform Real Business Transactions

Trial Balance Report After

Procure to Payment

Sample Data

1. Item:

i) 160-80194

ii) 136-10736

2. Item group: 100

3. Item model group: INV-STD

4. PO’s:

i) PO-006412 (Item 160-80194)

ii) PO-006413 (Item 160-80194)

iii) PO-006382 (Item 136-10736)

5. Fiscal period: October, 2017

6. Main accounts:

i) 1410: Finished Goods - Main Control

ii) 1470: Purchase Price Variance

iii) 2180: AP Clearing - Received/Un-invoiced

iv) 2110: AP Operating - Control

7. Financial dimensions:

i) Locations

(1) 80: Frankfurt

(2) 30: Chicago

Definition of Posting Profile

1. Product receipt: 1410

2. Purchase expenditure, un-invoiced: 1470

3. Purchase, inventory receipt: 1410

4. Purchase expenditure for product: 1410

5. Purchase accrual: 2180

Item group based posting profile:

Item model group:

Purchase Order Creation and Confirmation

There is no financial transaction for Purchase Order Creation and Confirmation. Open PO’s, however, have impact on inventory and master planning. The open quantities on open PO’s are considered as supplies of Ordered quantities.

Receiving of Confirmed Purchase Orders

When a product receipt is recorded for a stocked item and the item model group specifies that accounting entries are to be created, 2 processes take place:

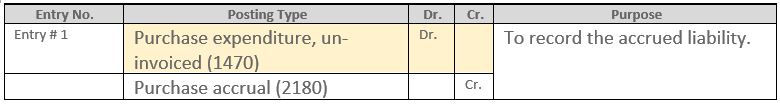

Accounting entry for the accrued liability

Cost in inventory for the received item

Vendor Invoicing

When a vendor invoice is recorded for a stocked item and accounting entries are created, 2 processes take place:

Accounting entry for the accrued liability is reversed. Liability for the vendor invoice is realized.

Cost in inventory for the received item is reversed. Inventory cost is realized under different ledger account.

Vendor Payment

Financial transactions related to vendor payment have not been included here in illustration.

Order to Cash

Sample Data

1. Item: 160-80194

2. Item group: 100

3. Item model group: INV-STD

4. SO’s:

i) SO-135004

ii) SO-135005

5. Fiscal period: October, 2017

6. Main accounts:

i) 1110: AR Operating - Control

ii) 1410: Finished Goods - Main Control

iii) 1495: Inventory Clearing - Shipped/Un-invoiced

iv) 4110: Sales

v) 5110: COGS

7. Financial dimensions:

i) Locations

(1) 60: Boston

Definition of Posting Profile

Packing slip: 1410

Packing slip offset: 1495

Issue: 1410

Consumption: 5110

Revenue: 4110

Item group based posting profile

Sales Order Creation and Confirmation

There is no financial transaction for Sales Order Creation and Confirmation. Open SO’s, however, have impact on inventory and master planning. The open quantities on open SO’s are considered as demands of On order quantities.

Picking, Packing and Shipping for Confirmed Sales Order

When a packing slip is recorded for a stocked item and the item model group specifies that accounting entries are to be created (Post physical inventory and Post to Deferred Revenue Account on Sales Delivery), 2 processes take place:

Accounting entry for the Deferred Revenue

Deduction in inventory for the shipped item

Customer Invoicing

When a customer invoice is recorded for a stocked item and accounting entries are created, 2 processes take place:

Accounting entry for the Deferred Revenue is reversed. Revenue for the customer invoice is realized.

Deduction in inventory for the received item is reversed. COGS is realized under different ledger account.

Customer Payment

Financial transactions related to vendor payment have not been included here in illustration.

Record to Report

T-Account Transactions

The relevant T-Account transactions are listed below.

Trial Balance Report Before Transactions

The fiscal period of October 2017 is used to illustrate the business scenarios.

Navigation: General ledge > Common > Trial balance

Perform Real Business Transactions

Purchase Orders:

PO-006412: Invoiced

PO-006413: Received

PO-006382: Invoiced

Sales Order:

SO-135004: Delivered

SO-135005: Invoiced

More Real Business Transactions

Purchase Orders:

PO-006417: Confirmed open PO with prepayments

PO-006418: Confirmed open PO with prepayments

T-Account Transactions:

Trial Balance Report After More Transactions

Summary of AX Financial Posting and The Impact to Logistics

Item model group determines what accounting events would have accounting entries posted to the subledger and general ledger. This will have impact both physically and financially, quantities and amounts.

New accounting engine in AX 2012 requires potential 2-step posting for both Physical events (Product receipt or Packing slip) and Financial events (Vendor invoicing or Customer invoicing).

Entries in a single event (e.g. Vendor invoicing) for the same ledger account combination could be summarized when posting to general ledger.

Costing method determines the amount for the inventory and COGS related posting entries. This is primarily impacting the financial side. In the example for Standard Costing, the standard cost is always used whenever the costing/inventory value entries are posted.

Posting profiles are defined at 3 different levels related to the Items and trading partners (Table, Group, All). The lower level overrides the higher level.

Subledger and General ledger should reconcile. The reconciliation can be a relatively easy process as long as posting profiles are defined correctly and in a clear fashion.

Comments